dog health insurance how much over a month, a year, and a lifetime really costs

I set out to map the numbers, not just chase them. Costs change by breed, age, zip code, and the kind of safety net you want. I hover over the "enroll" button, pause, and ask: what am I really paying for - today, and ten years from now?

The main drivers of cost

Premiums live at the intersection of risk and support. Higher risk usually means higher price, but you can shape that curve.

- Dog profile: breed size, age, and known hereditary risks.

- Where you live: vet fees and regional claim patterns.

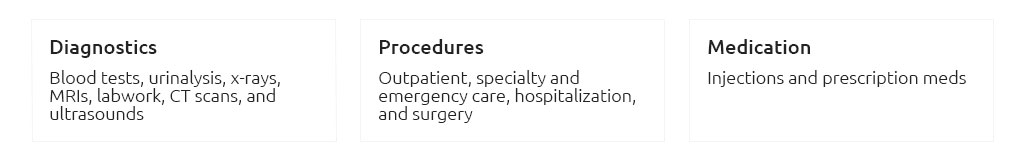

- Coverage scope: accident-only, accident + illness, or illness plus extras like rehab or dental injury.

- Deductible: higher deductible, lower monthly premium.

- Reimbursement rate: 70% - 90% is common; lower rate trims the monthly bill.

- Annual limit: $5k, $10k, or unlimited - higher limits usually cost more.

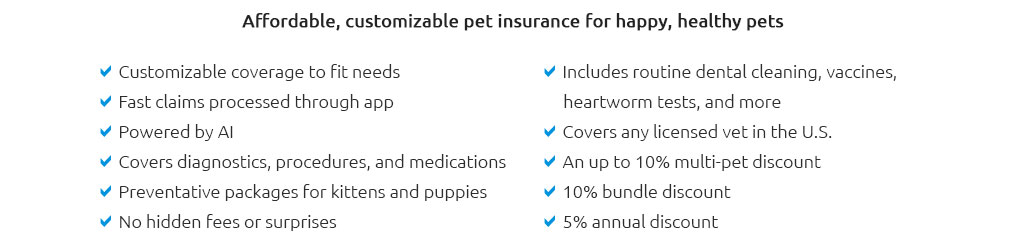

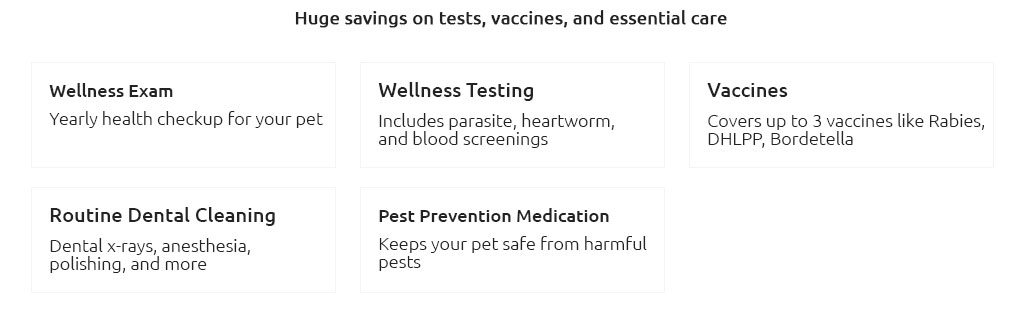

- Optional add-ons: wellness, behavioral, alternative therapies.

So, dog health insurance - how much per month?

Ranges below are typical for many households, but not promises. Think of them as trail markers.

- Accident-only: about $10 - $20 for small young dogs; $20 - $35 for large breeds.

- Core accident + illness: about $25 - $45 for small young dogs; $45 - $90 for large or older dogs.

- Broad coverage with high limits: about $90 - $140+, especially for big breeds or seniors.

Wellness riders can add roughly $10 - $25 monthly, depending on what's included.

One real-world moment

It's 7:42 p.m. in a quiet urgent-care lobby. The estimate for a torn cruciate repair is $2,500. My policy shows a $500 deductible and 80% reimbursement. Math in the margins: I'd pay the $500 deductible, then 20% of the remaining $2,000 - another $400 - total out-of-pocket about $900. I nod, exhale. The plan won't make the worry vanish, but it steadies the floor under my feet.

Yearly picture vs. lifetime arc

Short-term cost is the premium. Long-term cost is premium plus the care you avoid delaying.

- Year one: enrollment fees (if any), waiting periods, a modest premium if your dog is young and healthy.

- Middle years: premiums creep as your dog ages; claims frequency may rise.

- Senior years: higher premiums are common; coverage can still soften big shocks like cancer treatment or chronic meds.

If you keep coverage for 8 - 12+ years, you're choosing budget stability and access to care over purely minimizing expected spend. That trade often feels worth it during a bad day at the vet.

Ways to dial the price without losing trust

- Increase the deductible to lower monthly costs, but keep it at a level you can pay today.

- Choose 70% - 80% reimbursement instead of 90% if premiums feel tight.

- Right-size the annual limit: many claims fit under $10k, but high-risk breeds may benefit from more.

- Skip wellness add-ons if you already budget for routine care; buy it only if it truly offsets your costs.

- Mind exclusions: pre-existing conditions, waiting periods, and bilateral clause details for knees or hips.

Signals of a supportive insurer

- Clear policy language: definitions for hereditary, congenital, and chronic conditions.

- Claims experience: average reimbursement time and transparent itemized EOBs.

- Customer support you can reach: chat or phone that answers plainly under stress.

- Predictable renewals: honest notes about premium increases as pets age.

Quick estimating path you can try

- Start with a base: small/young dog around $25 - $40; large/young around $40 - $70; seniors add a noticeable bump.

- Adjust +$10 - $30 for high-cost metros or high-limit plans.

- Trim $5 - $15 by raising the deductible or choosing 70% reimbursement.

- Add wellness only if your routine care spend will actually be reimbursed.

If the number lands inside a comfortable monthly groove and you trust the policy to show up on the hard days, you're close.

What to read before you click "buy"

- Waiting periods: accidents vs. illnesses vs. orthopedic specifics.

- Bilateral conditions: knees, hips, eyes - check how one side affects the other.

- Prescription food and rehab: covered or not, and to what limit.

- Any-vet freedom: most policies reimburse licensed vets; confirm there's no network lock.

I go slow here on purpose. Rushing feels easy; unravelling a clause on a stressful night does not. Choose a structure you trust, at a price that supports you month after month. That's the quiet value behind the headline question: dog health insurance - how much - so you and your dog keep moving, together, even when the trail tilts.